Excitement About Offshore Banking

Table of ContentsNot known Factual Statements About Offshore Banking The Basic Principles Of Offshore Banking The Main Principles Of Offshore Banking The Of Offshore BankingThe Buzz on Offshore BankingThe Ultimate Guide To Offshore BankingNot known Details About Offshore Banking The 6-Minute Rule for Offshore BankingWhat Does Offshore Banking Mean?

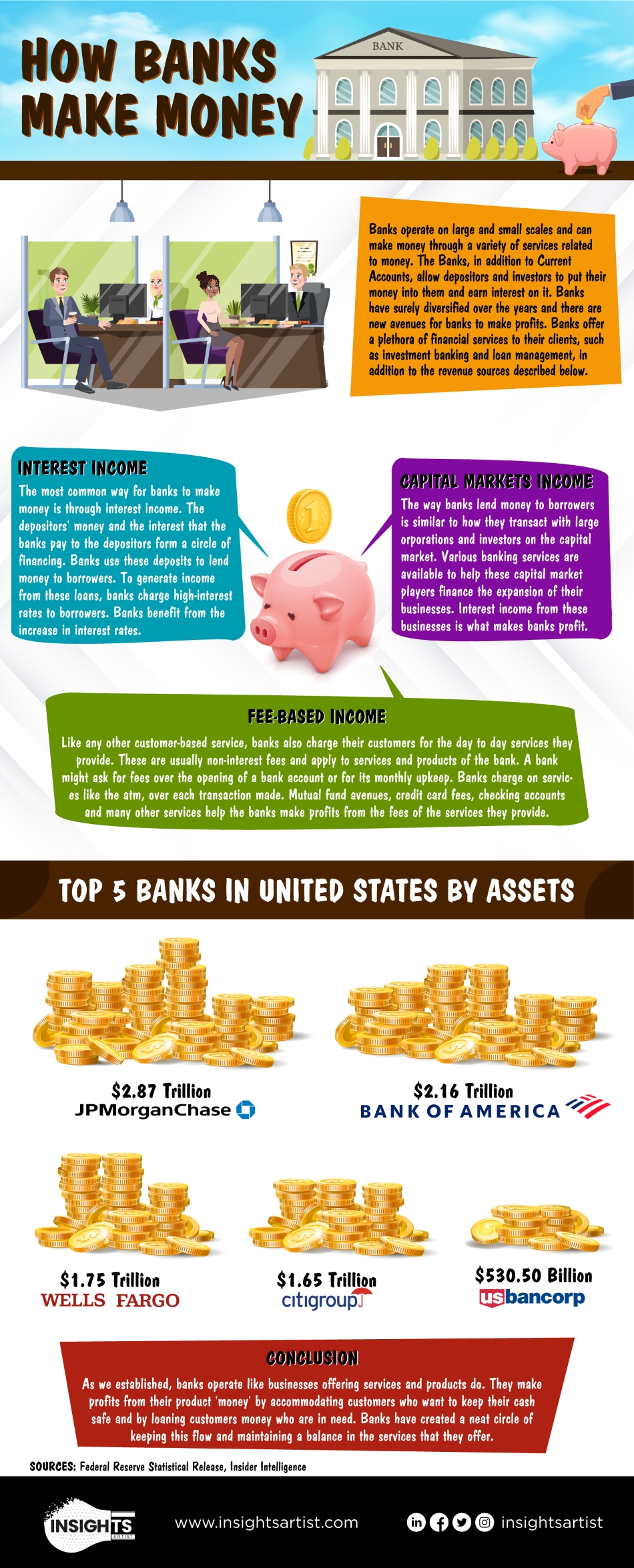

Banks do this by charging more rate of interest on the financings and other financial obligation they provide to consumers than what they pay to individuals who utilize their savings cars.

Facts About Offshore Banking Revealed

Banks make an earnings by charging even more rate of interest to borrowers than they pay on savings accounts. A financial institution's size is identified by where it lies and who it servesfrom small, community-based organizations to big industrial financial institutions. According to the FDIC, there were simply over 4,200 FDIC-insured commercial financial institutions in the USA as of 2021.

Convenience, rate of interest prices, as well as fees are some of the aspects that help customers determine their liked financial institutions.

More About Offshore Banking

This site can help you locate FDIC-insured banks and also branches. The objective of the Stocks Capitalist Protection Firm (SIPC) is to recover cash money as well as safeties in case a participant broker agent company fails. SIPC is a not-for-profit firm that Congress created in 1970. SIPC secures the clients of all registered brokerage firms in the united state

Offshore Banking Things To Know Before You Get This

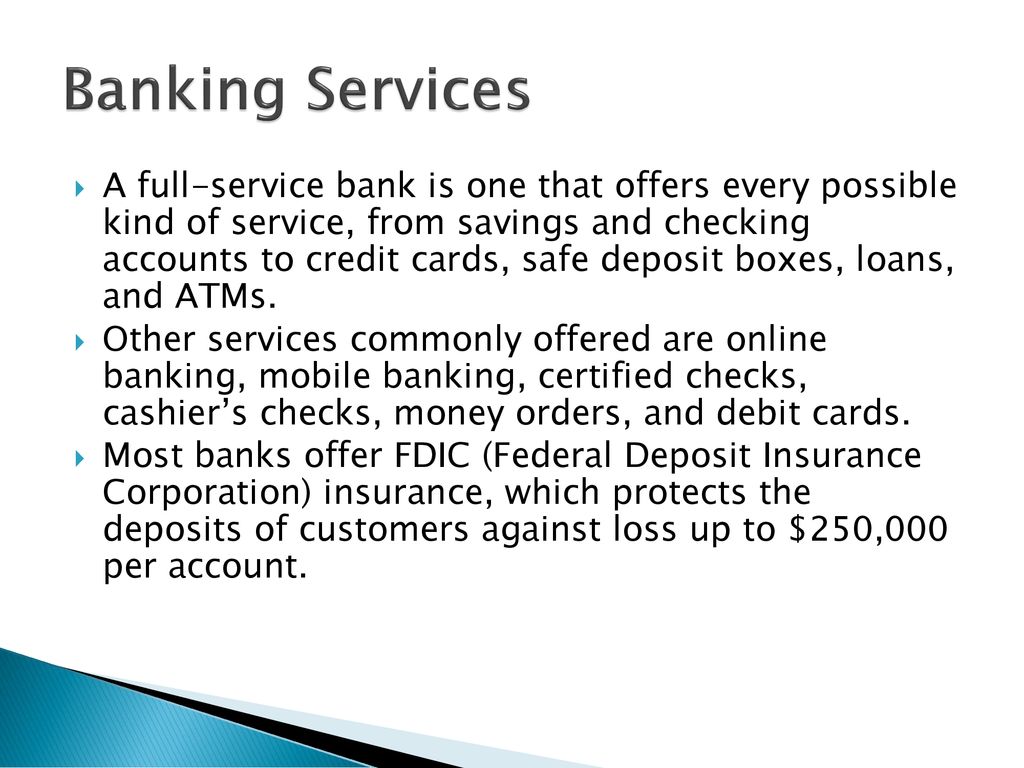

You ought to consider whether you intend to maintain both business as well as individual accounts at the exact same financial institution, or whether you desire them at separate financial institutions. A retail financial institution, which has fundamental financial services for clients, is the most ideal for everyday banking. You can select a conventional bank, which has a physical structure, or an on the internet bank if you do not want or need to physically see a bank branch.

, for instance, takes down payments as well as lends locally, which could use a more individualized banking connection. Pick a hassle-free place if you are visit site choosing a bank with a brick-and-mortar area.

Examine This Report about Offshore Banking

Some financial institutions also supply smart device apps, which can be helpful. Check the fees related to the accounts you intend to open up. Banks bill passion on car loans along with monthly maintenance charges, over-limit fees, as well as cord transfer costs. Some large banks are relocating to finish overdraft charges in 2022, to make sure that might be a crucial consideration.

After making some low deductions (in the form of compensation), the financial institution pays the costs's value to the owner. When the expense of exchange matures, the bank gets its payment from the celebration, which had actually approved the costs.

Some Known Facts About Offshore Banking.

Banks assist their customers in moving funds from one place to one more through cheques, drafts, and so on. A charge card is a card that enables its owners to make acquisitions of goods and also solutions for the credit card's service provider immediately get redirected here spending for the products or solution. The cardholder debenture back the purchase amount to the card company over some time as well as with interest.

Mobile banking (likewise referred to as M-Banking) is a term used for executing equilibrium checks, account transactions, settlements, credit score applications, as well as other banking purchases via a mobile device such as a cellphone or Personal Digital Assistant (PERSONAL ORGANIZER), Accepting deposits from savers or account owners is the main function of a financial institution.

About Offshore Banking

People favor to deposit their financial savings in a financial institution due to the fact that by doing so, they earn interest. Top priority banking can consist of several numerous services, yet some popular ones include cost-free checking, on-line costs pay, economic examination, as well as details. Individualized economic as well as banking services are typically provided to a bank's electronic, high-net-worth individuals (HNWIs).

Private Banks intend to match such individuals with the most ideal alternatives. offshore banking.

Unknown Facts About Offshore Banking

Not just more helpful hints are money market accounts Federal Down payment Insurance policy Corporation-insured, however they earn higher rate of interest than checking accounts. Cash market accounts minimize the danger of investing due to the fact that you always have accessibility to your cash you can withdraw it at any moment without penalty, though there might some limitations on the number of purchases you can make monthly - offshore banking.

Company financial typically supplies higher earnings for banks due to the fact that of the large quantities of money and rate of interest entailed with corporate lendings. Often both departments overlap in terms of their services, however the actual difference remains in the customers and the earnings each banking kind earns. A company lender jobs closely with customers to figure out which banking product or services best fit their requirements, such as company checking accounts, credit rating cards, treasury administration, lendings, even payment processing.

The 45-Second Trick For Offshore Banking

You intend to select a bank that uses a complete variety of solutions so it sustains your financial requires as your company expands. Right here are some of the features to seek. ACH enables cash to be transferred electronically without making use of paper checks, wire transfers or cash money. It can be utilized for both payables and also receivables.